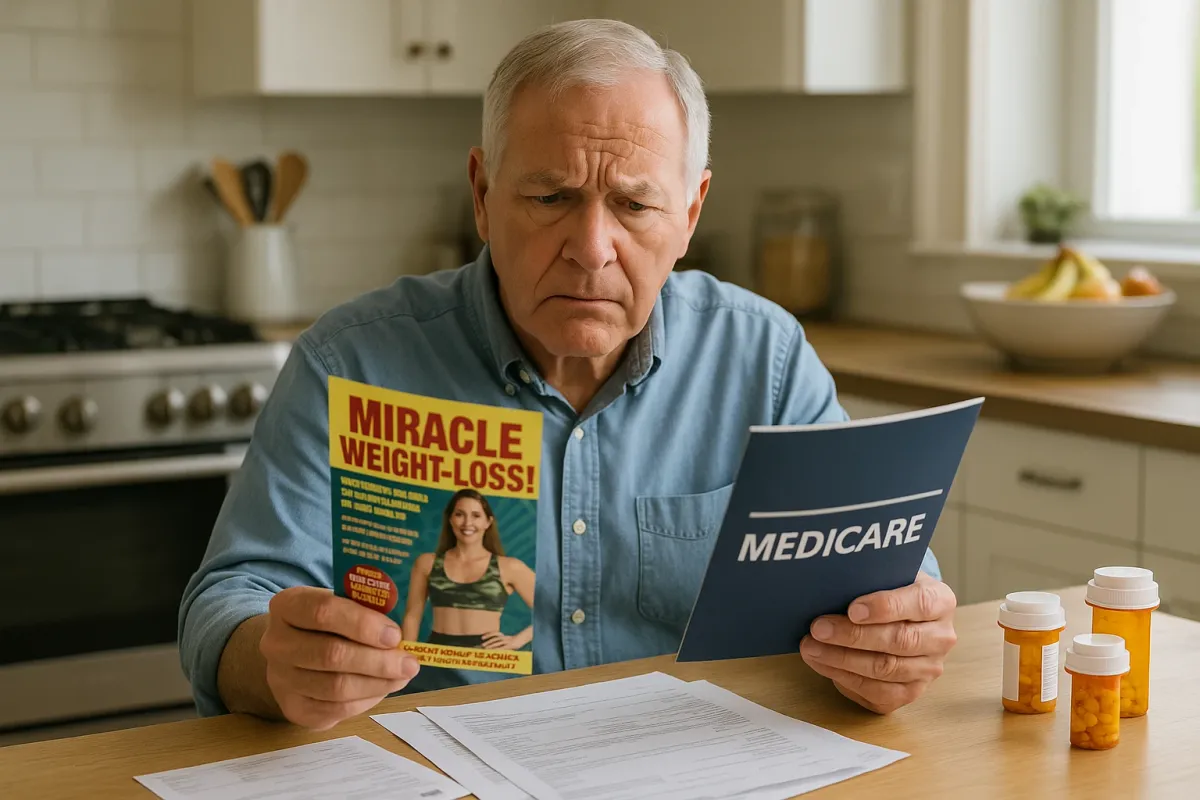

In a digital world where “miracle” weight‑loss offers appear between pet memes and viral comics, one trend from today’s headlines should give Medicare beneficiaries pause: the sharp rise in scams shared online, including fake health offers that quietly target older adults. A viral Reddit thread on scams people fell for is circulating widely right now, and while it might be entertaining, it’s also a stark reminder that Medicare‑aged adults—especially those seeking help with weight management—are prime targets for deceptive “coverage” pitches.

For readers of Weight Loss Medicare Blog, this moment is more than a curiosity. It’s an opportunity to step back, separate illusion from infrastructure, and understand how Medicare really approaches weight‑loss care in 2025—what is covered, what is not, and how to avoid being drawn into high‑risk, out‑of‑pocket schemes masquerading as “Medicare‑approved.”

Below are five refined, highly specific insights to help you navigate weight‑loss options within Medicare with the same discernment you’d bring to your financial portfolio or estate plan.

1. Medicare Does Not Pay for “Cosmetic Slimming” — No Matter How Persuasive the Pitch

One of the quiet threads emerging in today’s online scam stories is how effortlessly the language of legitimacy is borrowed: logos, “official”‑sounding plan names, and phrases like “Medicare‑preferred” or “fully covered for seniors.” In the weight‑loss space, this often surfaces as:

- “Medicare‑covered celebrity weight‑loss injections—no cost to you”

- “Free body contouring for Medicare patients—limited enrollment”

- “Guaranteed covered gastric sleeve, even if you don’t qualify under your plan”

Under current federal rules, Medicare does not cover services or medications when the primary purpose is cosmetic or appearance‑driven. That includes:

- Non‑medically necessary liposuction

- Cosmetic body contouring post‑weight loss (unless part of reconstructive care after a medically necessary procedure, and even then coverage is narrow and highly individualized)

- “Spa” or “wellness clinic” intravenous drips, fat‑melting injections, or non‑FDA‑approved devices

If the marketing language centers on appearance (“summer body,” “stubborn fat,” “tightening and toning”) rather than diagnosed disease (obesity, diabetes, cardiovascular risk), Medicare is almost certainly not paying the bill. Any site or caller suggesting otherwise—particularly if they ask for your Medicare number up front—should be treated as a red flag, not a shortcut.

2. Coverage Still Starts with a Diagnosis, Not a Discount Code

The stories trending today about people getting lured by clever offers echo an essential Medicare truth: coverage flows from documentation, not from advertising. For weight‑loss‑related services, Medicare typically requires:

- A **formal diagnosis** of obesity (body mass index ≥ 30) or a related condition such as type 2 diabetes, hypertension, sleep apnea, or cardiovascular disease.

- Evidence that weight contributes to a **medically significant risk**, not just dissatisfaction with appearance.

- In many cases, documentation of **prior attempts** at lifestyle modification—diet, activity, behavior change—before escalation to medications or surgery.

For example, Medicare’s Intensive Behavioral Therapy (IBT) for Obesity benefit under Part B is only available when:

- Your BMI is 30 or higher, and

- The counseling is provided by a qualified professional (often in a primary care setting), and

- The visits follow a specific, structured schedule (frequent visits initially, then maintenance).

No influencer code, free webinar, or “opt‑in today” promotion can bypass that structure. If a program promises “instant Medicare approval” without mentioning BMI, comorbidities, or your primary care provider, they are selling you a story, not a benefit.

3. Weight‑Loss Medications Are Entering Medicare… but Not as a Free‑for‑All

One of the most closely watched developments in health care this year is the shifting landscape around GLP‑1 drugs—medications such as semaglutide and tirzepatide, originally developed for diabetes and now widely publicized for weight loss. Headlines about coverage decisions have been everywhere, and scammers are paying attention.

Here is the refined reality for Medicare beneficiaries:

- **Medicare Part D and Medicare Advantage drug plans can cover GLP‑1 drugs when used for diabetes.**

- Historically, federal law has not allowed Medicare to cover medications used **solely** for weight loss.

- In 2024–2025, some plans began carefully expanding coverage when weight loss is part of managing serious cardiovascular disease or diabetes, in line with evolving FDA indications and CMS guidance.

The nuance matters:

- An ad promising “free semaglutide through Medicare for anyone over 65 who wants to slim down” is misrepresenting reality.

- A physician‑supervised plan that documents diabetes or cardiovascular risk, uses FDA‑approved indications, and submits prior authorization through your Part D or Medicare Advantage plan may, in certain cases, be legitimate.

For you as a discerning patient:

- **Ask your prescriber to run a formal coverage check** through your plan before you commit.

- Request the **exact drug name, strength, dosing frequency, and billing code** they intend to use; legitimate clinics can provide this in writing.

- Be wary of telehealth services that insist you pay thousands of dollars “until Medicare kicks in later” or promise reimbursement “once the law changes”—that is speculation, not coverage.

4. “Medicare Wellness” Weight‑Loss Programs: How to Tell Elegant from Exploitative

As the online world circulates lists of scams people regret, a subtler risk for Medicare beneficiaries is not outright fraud, but overpriced, under‑delivering wellness programs that drape themselves in medical language without offering true clinical value.

An elegant, ethically designed Medicare‑aligned weight‑loss program typically includes:

- **Coordination with your existing clinicians** (primary care, cardiology, endocrinology)

- Evidence‑based components: nutrition counseling, activity planning adapted to your physical abilities, behavioral coaching, and careful medication review

- Transparent communication about **what Medicare covers** (for example, IBT visits or diabetes self‑management training) versus which services remain **self‑pay**

By contrast, a program that should raise your suspicions often:

- Leans heavily on **scarcity** (“only 10 Medicare spots left”) or urgency (“enroll before open enrollment closes or miss out forever”)—even though program enrollment and Medicare open enrollment are separate issues.

- Cannot clearly state which sessions, labs, or tests are **billed to Medicare** and which are not.

- Uses fine print to convert a “no‑risk consultation” into a long‑term financing contract.

Before sharing your card, your signature, or your story:

- **Call your Medicare Advantage or Part D plan directly** and ask whether the program, provider, or clinic is in‑network and what your portion would be.

- Look for **National Provider Identifiers (NPIs)** and clinic addresses, and verify them against CMS’s public databases or your plan’s directory.

- Ask the program to give you a **sample claim form or superbill** showing CPT/HCPCS codes they typically use. Reputable organizations will not be offended by that request.

5. Protecting Your Medicare Identity Is Now a Core Part of Protecting Your Health

Today’s viral thread on scams is amusing—until you realize that for older adults, the stakes are profoundly higher. A compromised Medicare number can lead to:

- Fake claims in your name, which can complicate future legitimate approvals.

- Phantom “weight‑loss” visits or devices billed without your knowledge.

- Delays or denials when you truly need advanced care, because your record appears cluttered with suspicious utilization.

A few premium‑grade habits will serve you better than any trending hack:

- Treat your **Medicare Beneficiary Identifier (MBI)** like a credit card number. Never share it via social media DMs, text, or unsolicited calls—even if the caller claims to be from Social Security, CMS, a “Medicare weight‑loss center,” or your plan.

- Set a recurring reminder—quarterly or biannually—to **review your Medicare Summary Notices (MSNs)** or Explanation of Benefits (EOBs) for unfamiliar weight‑loss services, labs, or equipment.

- If you see something off, contact:

- Your plan’s member services

- 1‑800‑MEDICARE

- Or your state’s Senior Medicare Patrol (SMP), which specializes in educating and assisting beneficiaries around fraud and abuse.

Protecting your identity is not merely administrative; it preserves your ability to access legitimate, medically necessary weight‑loss interventions when you and your clinician decide it is time to act.

Conclusion

Today’s stories of clever scams may be entertaining to scroll, but for Medicare beneficiaries navigating weight loss, they are also a timely warning. In a world of frictionless click‑through offers and “Medicare‑approved” buzzwords, the true markers of quality are quieter: documented diagnoses, evidence‑based therapies, transparent billing, and clinicians willing to explain—in precise terms—how your care will be covered.

If you are considering any weight‑loss service, medication, or program marketed to “Medicare seniors,” pause and apply the same scrutiny you would to a major financial decision. Ask how it fits into your Part A, B, D, or Medicare Advantage benefits. Confirm every promise against your plan’s rules, not the sales page. In doing so, you transform weight management from a vulnerable point for exploitation into a carefully curated aspect of your long‑term health strategy—one that honors both your body and the coverage you’ve earned.

Key Takeaway

The most important thing to remember from this article is that this information can change how you think about Medicare Coverage.