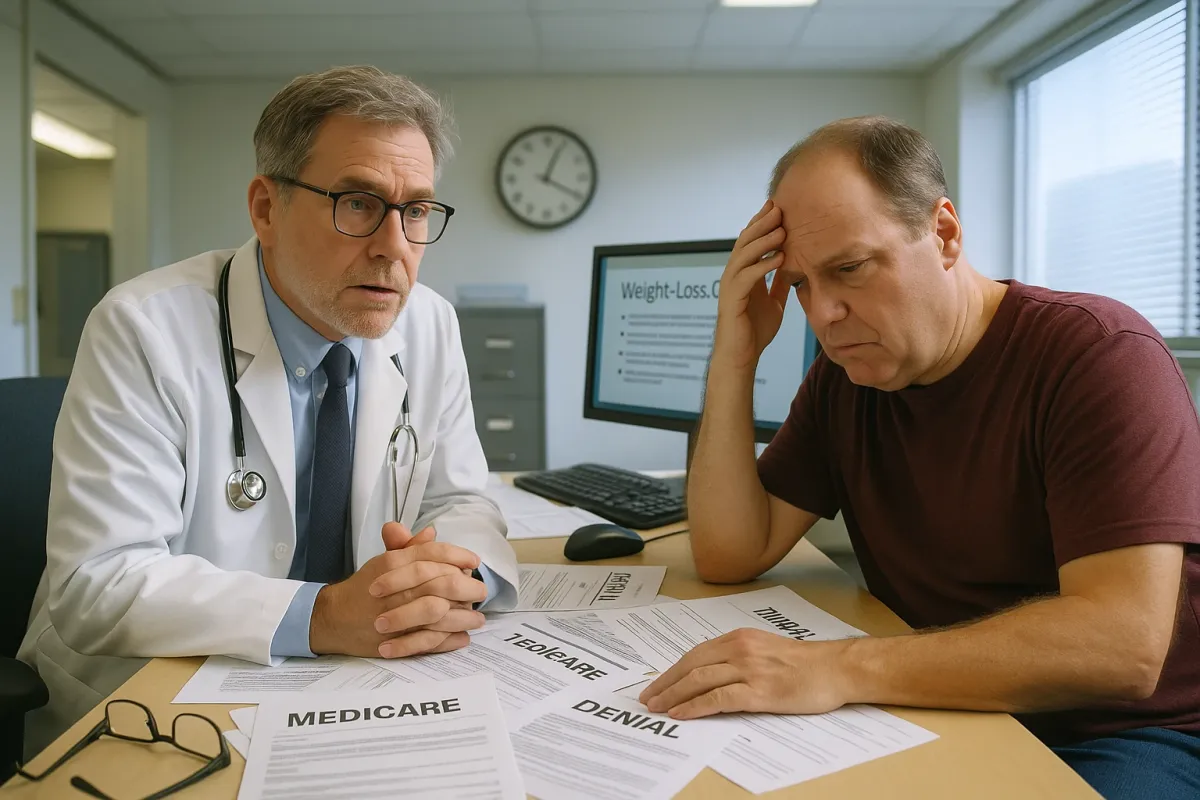

For many Medicare beneficiaries, the journey to secure coverage for modern weight‑loss care feels eerily like those viral “Not My Job” moments currently circulating online—where a task is technically done, but done so half‑heartedly it borders on parody. A street sign installed backwards. A ramp that ends in a wall. A painted line across a pothole. Amusing on social media; devastating when the same mentality shows up in healthcare administration.

The trending photo collection of people proudly doing the bare minimum may be light entertainment, but it offers a surprisingly sharp mirror for anyone trying to navigate obesity care through Medicare in late 2025. In a system where every form, code, and clinical note matters, “not my job” thinking can quietly derail an otherwise eligible claim for weight‑loss treatment—especially as conversations around GLP‑1s and obesity medicines intensify in Washington and the media.

This is the moment to take the opposite approach. Instead of relying on a patchwork of hurried office visits and incomplete documentation, Medicare beneficiaries seeking weight‑loss support must orchestrate their coverage like a well‑run boutique service: precise, proactive, and impeccably documented. Below are five exclusive, highly practical insights to help you step beyond the “not my job” culture and assume elegant ownership of your Medicare eligibility journey—without becoming your own full‑time billing specialist.

1. Treat Eligibility as a Project, Not a Paperwork Afterthought

The “Not My Job” trend shows what happens when everyone assumes someone else has the full picture. In Medicare, that assumption is costly. Eligibility for weight‑related services is rarely confirmed by a single checkbox; it is established through a tapestry of diagnoses, vital signs, lab values, and documented attempts at lifestyle interventions.

Begin by quietly elevating your expectations: consider your eligibility not as a line item in a rushed appointment, but as an ongoing project you direct. Create a dedicated “coverage portfolio” for your weight‑related care—physical or digital. Include recent visit summaries, medication lists, copies of lab work (A1c, fasting glucose, lipid panel), and any imaging or cardiology reports that reflect obesity‑related complications such as sleep apnea, osteoarthritis, or cardiovascular disease.

When you attend appointments, bring this portfolio and refer to it deliberately. This is not about being demanding; it is about being clear. Instead of passively waiting to see what your clinician “puts in the chart,” you are curating a coherent medical narrative that consistently supports your medical need for weight‑loss interventions. When prior authorizations, appeals, or coverage reviews arise, you will not be scrambling—you will be prepared.

2. Use the “Dual Diagnosis” Strategy: Obesity + Impact

Medicare is increasingly attentive to obesity as a serious chronic disease, but coverage decisions still tend to hinge on impact rather than weight alone. In other words, a BMI without context often functions like those poorly executed projects in the viral photos—technically present, functionally useless. To strengthen your eligibility, you and your clinician should think explicitly in pairs: one code for obesity, and one (or more) for its documented consequences.

For example, “obesity” paired with “type 2 diabetes,” “hypertension,” “coronary artery disease,” “obstructive sleep apnea,” or “severe osteoarthritis” paints a medically complex picture that is far more compelling to Medicare reviewers than a single line on a problem list. In the current policy climate, where GLP‑1 drugs are widely covered for diabetes but not uniformly for obesity alone under Medicare, framing your case around metabolic disease or cardiovascular risk is more than semantics—it can be the difference between access and denial.

Work with your physician to ensure these dual elements are consistently present:

- A clear obesity diagnosis (or overweight with specified BMI).

- Specific, measurable comorbid conditions and functional limitations (difficulty walking, need for joint replacement, recurrent falls, uncontrolled blood pressure, etc.).

This is not “gaming” the system; it is accurately translating the full burden of your condition into the language Medicare uses to assess necessity.

3. Turn “Lifestyle Attempts” into a Structured, Verifiable Record

Many Medicare‑related weight services—especially intensive behavioral counseling, nutrition therapy in the context of diabetes, or supervised weight‑management programs—quietly require evidence that lifestyle measures have been tried in a serious, sustained way. Without proof, you risk being treated like the person who painted a yellow line straight over a manhole: technically compliant, substantively unserious.

Instead of vaguely telling your clinician, “I’ve tried diets,” convert your efforts into a structured record. Keep a simple, elegant log that includes:

- Program names (e.g., a commercial weight program, medical weight‑management clinic, or Diabetes Prevention Program).

- Start and end dates.

- Approximate weight changes over time.

- Brief notes on adherence and challenges (travel, caregiving, medication side effects).

Bring this log to your appointment. Ask that your attempts and outcomes be summarized in the note—“patient has participated in structured calorie‑restricted diet and walking program for six months with modest weight loss and subsequent plateau,” for example. Medicare reviewers rarely see your personal story; they see clinical shorthand. Ensuring your efforts are translated into that shorthand is essential to supporting coverage for more advanced interventions if and when they become appropriate.

4. Quietly Audit Your Medicare Advantage or Supplement Plan for Weight‑Related Benefits

The current flood of “Not My Job” images reflects a deeper truth: when no one is clearly responsible, the outcome is usually substandard. The same dynamic often applies to Medicare Advantage and supplemental plans, where weight‑related benefits are scattered across different documents—care management programs, wellness incentives, nutrition consults, telehealth coaching—without anyone actively curating them for you.

Schedule a calm, focused 30‑minute call with your plan’s member services or dedicated care navigator. Do not simply ask, “Do you cover weight loss?” Instead, pose deliberate, targeted questions:

- “Which services do you cover for obesity, diabetes, or heart‑disease risk reduction?”

- “Do you offer intensive behavioral counseling for obesity, and if so, where can I receive it?”

- “Are any registered dietitians available under my plan for nutrition counseling tied to diabetes or heart disease?”

- “Do you have care‑management programs, digital tools, or coaching specifically for weight, diabetes prevention, or cardiac risk?”

Request written confirmation or links to benefit descriptions, and add them to your coverage portfolio. Many high‑value services are available—often at low or no out‑of‑pocket cost—but remain underused simply because no one has taken ownership of presenting them clearly. By conducting your own quiet benefit audit, you avoid the “not my job” drift and ensure you are leveraging the full suite of tools you are already paying for.

5. Prepare for Policy Evolution: Position Yourself Ahead of the Curve

As public debate around GLP‑1s and other obesity medications intensifies—driven by pharmaceutical earnings calls, high‑profile patient stories, and policy discussions—Medicare’s stance is under unprecedented scrutiny. While coverage for obesity drugs under traditional Medicare remains tightly constrained today, it is increasingly plausible that carefully defined pathways will emerge: perhaps linked to cardiovascular risk reduction, diabetes prevention, or structured obesity‑care programs.

The beneficiaries who will move most seamlessly into any future coverage expansion will be those whose medical records already tell a precise, long‑standing story: stable documentation of obesity, clear comorbidities, attempts at lifestyle treatment, and careful monitoring of cardiovascular and metabolic risk markers. That is what payers look for when they introduce step‑therapy requirements or determine who meets “high‑risk” criteria.

You do not need to predict the exact policy language to prepare intelligently. Work with your clinician now to:

- Ensure your BMI and weight trajectory are recorded consistently over time.

- Monitor and document blood pressure, A1c, cholesterol, and sleep apnea status.

- Capture functional limitations that matter in daily life (difficulty climbing stairs, standing for work, caring for grandchildren).

- Consider referral to multidisciplinary obesity care or cardiac risk‑reduction clinics if accessible.

In essence, you are future‑proofing your eligibility narrative—so that when policy shifts, you are not starting from a blank page.

Conclusion

The viral “Not My Job” images are amusing precisely because they show how absurd outcomes become when no one takes genuine responsibility for quality. In the arena of Medicare and weight‑loss care, that same dynamic is anything but funny. A missing diagnosis here, a vague note there, an unasked question about plan benefits—these small omissions can quietly close doors to services you arguably qualify for.

By treating your eligibility as a curated project, insisting on dual documentation of obesity and its impact, turning lifestyle efforts into verifiable evidence, auditing your plan for hidden benefits, and positioning yourself ahead of policy evolution, you transform a fragmented process into an intentional, high‑standard experience.

In a healthcare landscape where millions accept “good enough” as the norm, choosing to manage your Medicare weight‑loss eligibility with this level of refinement is not simply administrative; it is an act of self‑respect.

Key Takeaway

The most important thing to remember from this article is that this information can change how you think about Eligibility Guide.