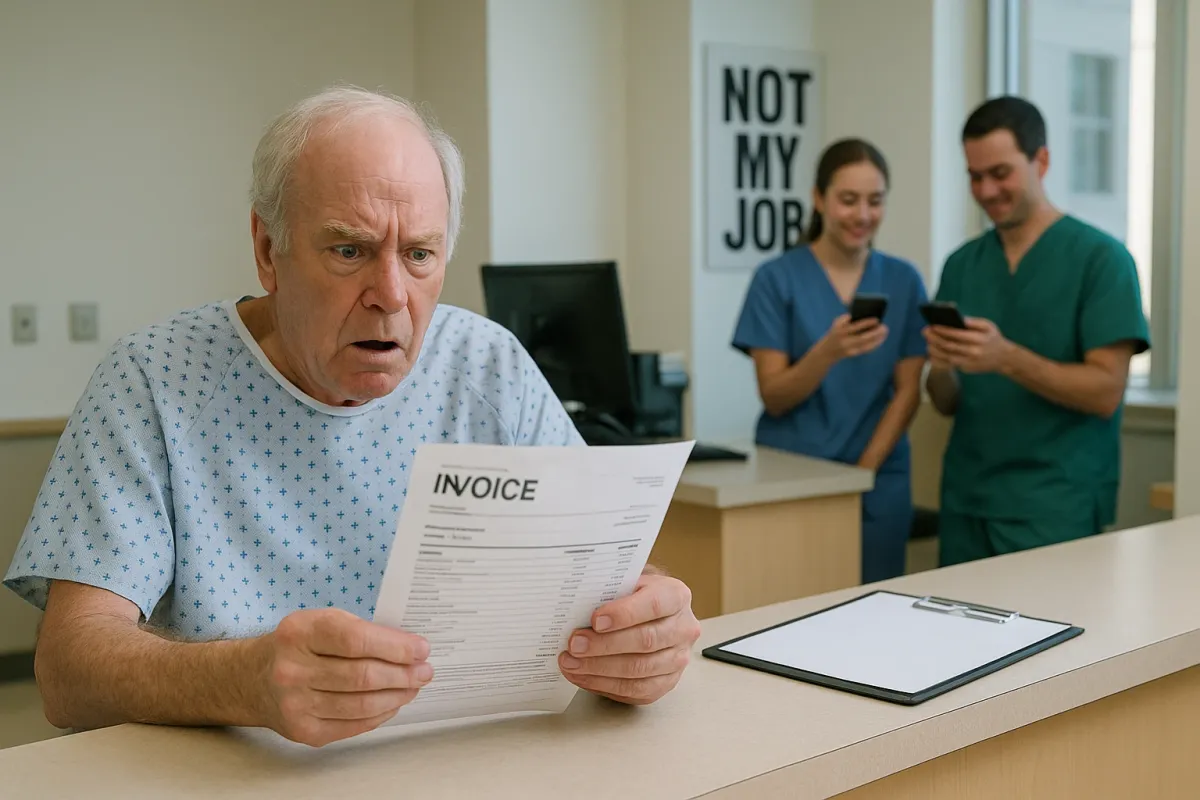

There is something darkly funny about those viral “Not My Job” photos—paint carefully brushed around a fallen leaf, a crosswalk striped neatly over a manhole, a “Do Not Enter” sign bolted to an always‑open gate. But for Medicare beneficiaries navigating weight‑loss coverage, that same energy feels far less amusing. As images of extreme workplace laziness trend across social media, they echo a quieter, more consequential reality in healthcare: each “not my job” moment in the system can translate into delays, denials, or outright missed opportunities for covered obesity care.

Today, obesity and its related conditions are at the center of policy debates, GLP‑1 headlines, and Medicare reform discussions. Yet beneficiaries still encounter an invisible relay race of responsibility—between doctors, Medicare Advantage plans, pharmacies, and Part D formularies—where a single dropped baton can derail access to legitimate, evidence‑based weight‑management support. Inspired by the viral fascination with jobs half‑done, this piece turns that lens onto Medicare: where are the quiet gaps, and how can sophisticated, health‑literate beneficiaries step in—gracefully, strategically—before “not my job” becomes “not covered”?

Below are five refined, highly practical insights tailored for Medicare beneficiaries who care deeply about weight management, metabolic health, and protecting their coverage with intention rather than panic.

Insight 1: Medicare Advantage Plans Are Quietly Redrawing the Weight‑Loss Map

Original Medicare (Parts A and B) remains conservative in how it defines obesity‑related benefits. It will generally cover intensive behavioral therapy (IBT) for obesity in primary care and medically necessary visits related to conditions like diabetes, heart disease, and sleep apnea—but not “weight‑loss programs” as a consumer might imagine them, and not most prescription weight‑loss drugs. Against that backdrop, Medicare Advantage (MA) plans—private insurers administering Medicare benefits—have quietly become the main experimental laboratory for modern obesity care.

In the same way the “Not My Job” memes show workers doing only the narrowest fraction of what’s possible, many MA plans technically meet Medicare’s coverage requirements while either subtly enhancing or quietly restricting weight‑loss‑adjacent benefits. Some plans now bundle nutrition counseling, digital coaching apps, fitness memberships, or bariatric surgery networks into their “extra benefits,” while others strip these options to the bare minimum and rely heavily on prior authorization. For beneficiaries who want structured weight management, the key is to treat Medicare Advantage enrollment not as a generic insurance decision, but as a curated selection process: examine whether a plan includes obesity‑related behavioral counseling, chronic‑care management, or lifestyle programs beyond the legal minimum. In an environment where federal rules lag behind emerging therapies, plan design is becoming a de facto policy lever—and discerning beneficiaries can leverage it.

Insight 2: GLP‑1 Buzz Is Overshadowing What Medicare Actually Covers Today

News cycles and pharmacy counters alike are dominated by GLP‑1 names—Ozempic, Wegovy, Mounjaro, Zepbound—creating the impression that modern weight‑loss equals “injectable or nothing.” Yet Medicare’s current framework is still anchored in something far less flashy: physician‑supervised behavioral therapy, management of obesity‑related conditions, and, in select cases, bariatric surgery. While some Medicare Advantage and Part D plans have begun to cover GLP‑1s for certain indications (especially type 2 diabetes), comprehensive weight‑loss coverage using these agents remains the exception, not the rule.

The disconnect mirrors those “paint around the obstacle” photos: the system acknowledges obesity as a risk factor, but often skirts around offering the most direct contemporary tools to address it. Until federal rules explicitly modernize coverage for anti‑obesity medications, the most refined strategy is to combine what Medicare already supports—primary‑care visits, IBT for obesity, diabetes management, cardiology care—with self‑funded or plan‑supplemented options when needed. Beneficiaries who treat GLP‑1s as the sole metric of “good coverage” may miss more modest, but highly actionable benefits already on the table: covered labs to personalize nutrition, supervised physical therapy for mobility, and structured follow‑up visits that create an accountable, medically documented weight‑loss journey. In this environment, excellence is less about chasing the trend and more about orchestrating the benefits Medicare already acknowledges.

Insight 3: Documentation Is the New Currency of Coverage

The viral “Not My Job” images are, at their core, documentation—proof that someone technically did the work, even if the outcome is absurd. In Medicare, however, documentation is not a punchline; it is the quiet currency that separates approved claims from denials, and covered obesity‑related care from “patient responsibility.” For beneficiaries who care about weight loss, the elegance lies in becoming proactive stewards of that documentation rather than passive bystanders.

This means ensuring your medical record explicitly reflects obesity or overweight with comorbidities, not just scattered mentions of “needs to lose weight.” Ask your clinician whether your body mass index (BMI), blood pressure, A1c, lipid profile, sleep apnea diagnosis, joint pain, and other relevant factors are coded accurately and consistently. When your physician recommends nutrition counseling, physical therapy, or behavioral therapy focused on weight loss, request that the rationale be tied to specific conditions Medicare already prioritizes—diabetes, heart failure, hypertension, osteoarthritis, and others. A richly documented clinical picture transforms your care from “optional lifestyle support” into medically necessary risk reduction. In a system where every actor is tempted to do only what is absolutely required, an impeccably curated record gently compels them to do just a bit more.

Insight 4: Bariatric Surgery Networks Are Becoming Medicare’s “Premium Lane” for Obesity Care

While anti‑obesity medications remain in policy limbo, bariatric surgery sits on firmer Medicare ground—when strict criteria are met. Medicare may cover certain bariatric procedures for beneficiaries with a BMI above a defined threshold and at least one serious obesity‑related condition, provided the surgery is performed at an approved center of excellence. As insurers refine their networks, these bariatric pathways are evolving into something of a premium lane for beneficiaries whose weight‑related health has reached a critical inflection point.

The key distinction is that bariatric coverage is not merely about the operation; it often includes pre‑operative nutrition counseling, psychiatric evaluation, and rigorous follow‑up—elements that can act as a structured scaffold for sustainable weight management. However, these networks can also exhibit “Not My Job” tendencies: fragmented handoffs between surgeons, primary‑care providers, dietitians, and mental‑health professionals. Sophisticated beneficiaries can counter this by treating themselves as the central coordinator: requesting clear roadmaps of pre‑ and post‑operative care, confirming that all providers are in‑network and Medicare‑approved, and insisting on written follow‑up plans that integrate medical, nutritional, and behavioral guidance. In the right hands, bariatric coverage is less a last resort and more a carefully architected health redesign.

Insight 5: The Most Powerful Advocate in the Room Is Still You

The appeal of those viral laziness memes is that they reveal something uncomfortably human: most systems, left untouched, will default to the narrowest interpretation of “enough.” Medicare is no different. Plans will do what the rules require; busy clinicians will do what the schedule allows; pharmacies will do what the formulary permits. The gap between that baseline and truly optimal obesity care is where beneficiary advocacy lives—and where a premium, intentional approach becomes essential.

For Medicare beneficiaries invested in weight loss, advocacy does not mean confrontation; it means precision. It is the calm question during an appointment: “Is there an obesity‑specific benefit Medicare would cover that we’re not using yet?” It is the annual review of your plan’s Evidence of Coverage to identify hidden gems—nutrition programs, telehealth coaching, gym memberships, or care‑management teams. It is asking your pharmacist whether a medically necessary alternative is on formulary before assuming a drug is simply “not covered.” And when a denial arrives, it is treating the appeals process not as a bureaucratic insult but as a structured, winnable negotiation—backed by documentation, clinical guidelines, and, when needed, your provider’s explicit support. In a culture amused by “not my job,” choosing to quietly own your role as the final coordinator of your care is both radical and exquisitely practical.

Conclusion

The internet may laugh at poorly painted lines and misplaced signs, but in healthcare those same instincts toward minimal effort have real costs. For Medicare beneficiaries pursuing weight loss, the system will rarely volunteer its best options; it will, instead, do only what the rules insist upon and habit permits. The opportunity—and the elegance—lie in recognizing where “not my job” attitudes lurk and then, with deliberation and grace, stepping into the space they leave behind.

By selecting Medicare Advantage plans with intention, understanding the limits of GLP‑1 coverage, curating impeccable medical documentation, leveraging bariatric networks as structured care pathways, and embracing your role as your own principal advocate, you transform a fragmented system into a more responsive one. The memes may remain amusing, but your health strategy does not need to mirror them. In a world where everyone is doing just enough, you are allowed—and fully equipped—to ask for, and quietly secure, something better.

Key Takeaway

The most important thing to remember from this article is that this information can change how you think about Medicare Coverage.